Available Only In App

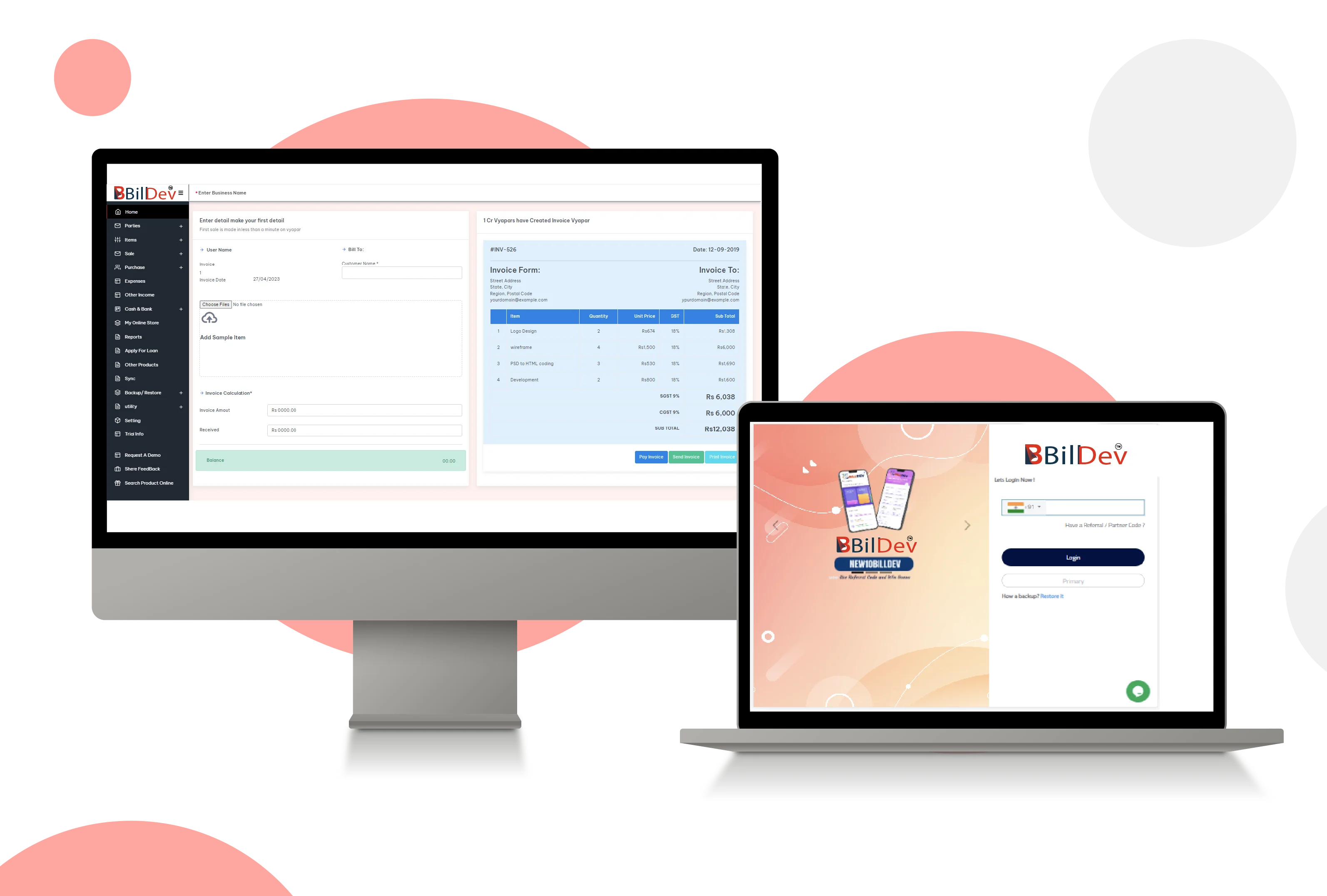

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

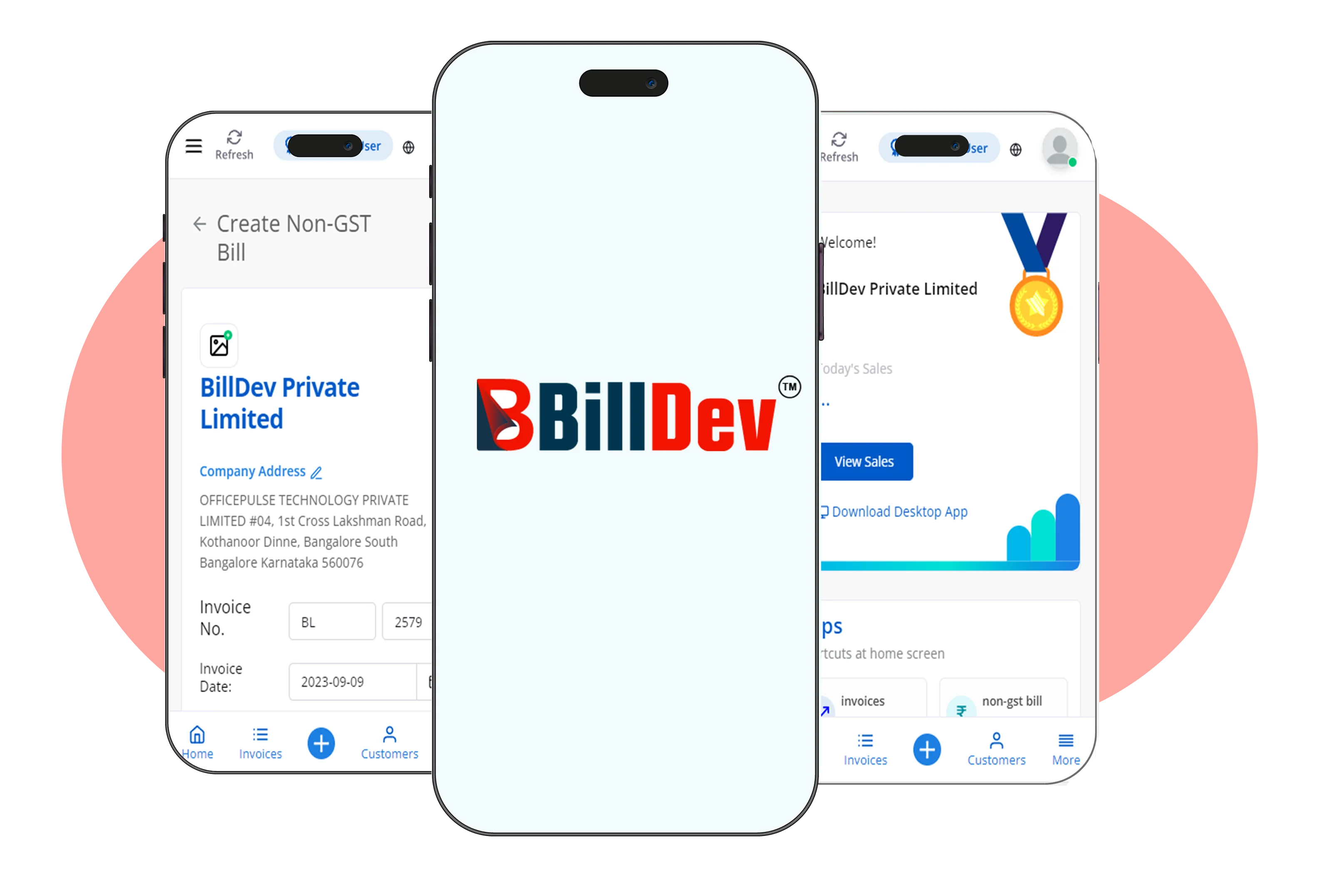

BillDev app for your Android devices will help your business with simple and effortless GST billing. Using our app, you can create customized invoices and share them with your clients on WhatsApp. The app will help you manage inventory, generate estimate bills and reports, track invoices, send payment reminders to clients, and collect payment via UPI payment options

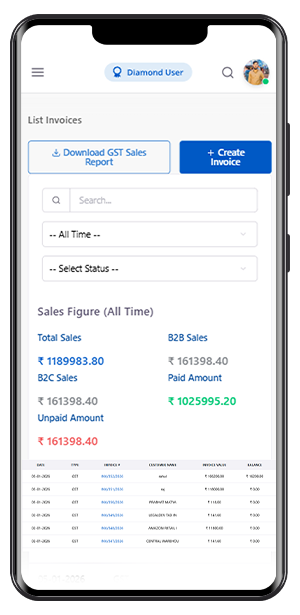

BillDev GST billing software will automate and simplify the process of invoice creation with accurate GST calculations. Your business can adhere to the GST regulations with transactions containing appropriate tax rates and codes. Why should you download our software? Here are the reasons.

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

Download the desktop application of BillDev with numerous features to help your business grow. Our software can work well on desktops to ensure you get customized solutions that will meet your unique business requirements.

*We’re willingly is here to answer your question about aila