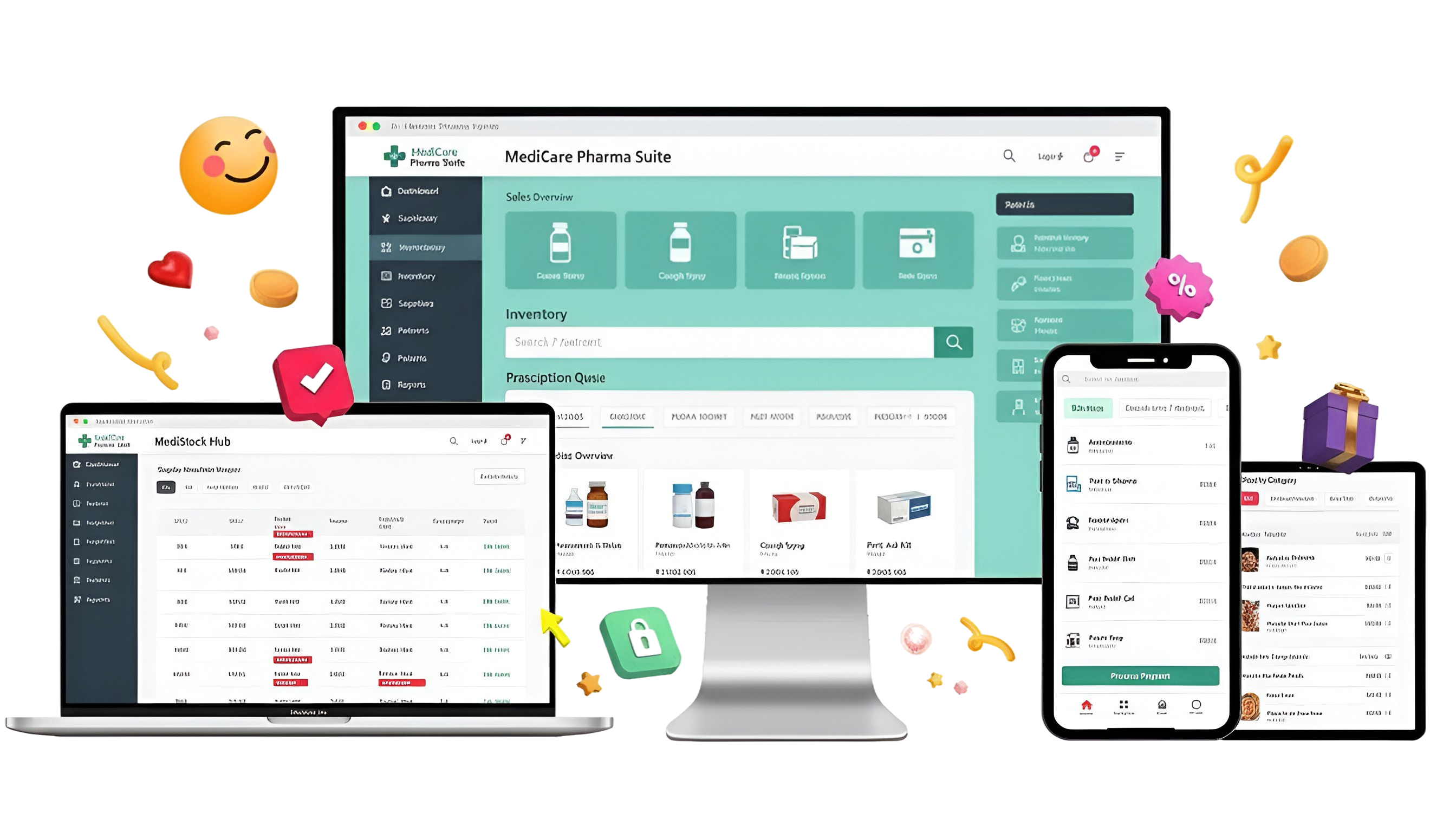

- GST billing software offers businesses digital tools to simplify the management of Goods and Services Tax (GST) regulations. This system automates tax calculations, generates invoices, manages return filing, and keeps records organized. It reduces manual effort and minimizes errors across processes by applying accurate GST rates on invoices.

- The software generates valid GST invoices with required details such as GSTIN, HSN/SAC codes, and tax breakup. It helps businesses stay compliant with government rules while enabling real-time tracking of tax liabilities, payments, and input tax credits. The software works through the GSTN (Goods and Services Tax Network) to ensure smooth return filing and provides timely alerts to avoid penalties. Most modern GST billing solutions also support automated E-Way Bill generation and GSTR filing. Online GST billing tools allow automatic form filling, transaction reconciliation, and instant report generation, saving time with accurate tax submissions. Businesses can access tax records anytime, from anywhere, with secure data storage and backup to reduce the risk of data loss. Overall, GST billing software simplifies tax compliance and improves financial accuracy for efficient business operations across all business types.